导读:(北京)去年股市震荡余波未了,中国政府于周五宣布,一位杰出的投资者兼中国最大的证券交易公司总经理因内幕交易指控而被批准逮捕。

BEIJING (AP) — A prominent investor and the general manager of China’s biggest stock brokerage have been arrested on insider trading charges, the government announced Friday, in the latest aftershock from a plunge in stock prices last year.

(北京)去年股市震荡余波未了,中国政府于周五宣布,一位杰出的投资者兼中国最大的证券交易公司总经理因内幕交易指控而被批准逮捕。

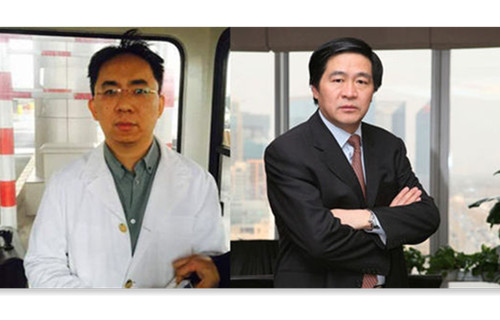

Xu Xiang, an investment fund manager who was detained Nov. 2, is charged with "stock market manipulation and insider trading," the official Xinhua News Agency said, citing law enforcement agencies in the eastern city of Qingdao. The two-sentence report gave no other details.

新华社援引青岛执法部门报道称,于去年11月2日被逮捕的基金经理徐翔被控涉嫌操纵证券市场、内幕交易。仅仅两句话的报告并未透露其他细节信息。

An employee who answered the phone at the economic crimes unit of the Qingdao police department said he had no information. Calls to the police ministry in Beijing were not answered.

青岛警方经济犯罪部门的一位雇员在电话采访中称其不知任何有关信息,而打给北京公安部门的电话也无人接听。

The general manager of state-owned Citic Securities Ltd., Cheng Boming, and two other Citic managers were arrested on similar charges, Xinhua said. It gave no details.

新华社还报道称,国有公司中信证券总经理程博明和另外两名中信的经理也被因涉嫌相似罪行而被逮捕。但除此之外没有别的细节信息。

The market benchmark soared more than 150 percent beginning in late 2014 after the state press said stocks were cheap. That led investors to believe Beijing would prop up prices if needed.

在2014年年底官媒宣传股价过低之后,市场基准暴涨150%以上。这让投资人们以为政府会在必要时刻保住股价。

Prices hit a peak June 12 and collapsed after changes in banking regulations fueled suspicions Beijing might withdraw its support. The benchmark fell more than 30 percent, inflicting heavy losses on novice investors who had bought in near the peak.

2014年6月12日,市场迎来最高股价。然而银行管理制度改革掀起了对政府不再支持股价的恐慌,导致股价大跌。市场基准下跌超过30%,给许多在最高股价附近入仓的新手股民们造成巨大损失。

The downturn triggered complaints politically favored insiders profited at the expense of small investors. Beijing responded by barring large shareholders from selling and ordering executives to buy back stock in their companies.

股票大跌引发众多不满,人们抱怨政策支持致使内部人员从普通股民身上敛财。而政府则以禁止大股东抛售股票和公司高管回购本公司股票等政策作为回应。

The police ministry said in July it had evidence securities firms were "illegally manipulating securities and futures exchanges." It has yet to explain what they are accused of doing.

七月,公安部门表示已经掌握了证券公司“非法操纵市场和外汇期货”的争取。但是其并未解释这些公司具体涉嫌何种罪名。

In August, Xinhua said eight Citic employees and one current and one former employee of the Chinese market regulator were suspected of illegal stock trading. A reporter for a business magazine also was detained.

八月,新华社报道称,八名中信证券员工以及两名中国市场监管部门前职工和县职工被怀疑涉嫌非法证券交易。一位财经记者也被拘留。

In November, Citic and two other brokerages, Guosen Securities Ltd. and Haitong Securities Ltd., said separately they were under investigation.

十一月,中信证券、国信证券以及海通证券分别表示各自都在接受调查。