The former CEO of collapsed Bitcoin exchange MtGox heads to trial in Tokyo next week on charges stemming from the disappearance of hundreds of millions of dollars worth of the virtual currency from its digital vaults.

Frenchman Mark Karpeles – once the high-flying head of the world's busiest Bitcoin trading platform, who reportedly lived in an 11,000 US dollar-a-month penthouse and spent money lavishly, including on prostitutes – is facing embezzlement and data manipulation charges.

"He is keeping calm as the trial gets underway," his lawyer Kiichi Iino told AFP, adding that Karpeles plans to plead his innocence.

The 32-year-old was first arrested in August 2015 and released on bail nearly a year later over allegations he fraudulently manipulated data and pocketed millions worth of Bitcoins.

Frenchman Mark Karpeles is facing embezzlement and data manipulation charges. /AFP Photo

MtGox, which claimed it once hosted around 80 percent of global Bitcoin trading, shuttered in 2014 after admitting that 850,000 coins – worth around 480 million US dollars at the time – had disappeared from its vaults.

The company initially said there was a bug in the software underpinning Bitcoins that allowed hackers to pilfer them. Karpeles later claimed he had found some 200,000 of the lost coins in a "cold wallet" – a storage device, such as a memory stick, that is not connected to other computers.

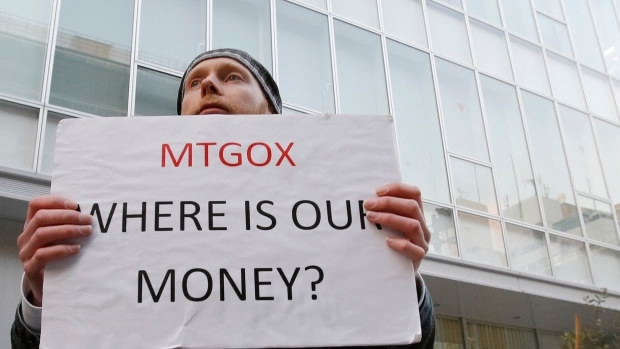

Tokyo-based MtGox filed for bankruptcy protection soon after the cyber-money went missing, leaving a trail of angry investors calling for answers and denting the virtual currency's reputation.

Protesters gathered in front of the building where MtGox, a digital marketplace operator, is housed in Tokyo. MtGox announced earlier 2014 that about 850,000 of its bitcoins were missing, most likely due to theft. /Reuters Photo

Soaring popularity

Despite the demise of MtGox and concerns about security, Bitcoin and hundreds of rival digital currencies are becoming increasingly popular and accepted by merchants worldwide.

Bitcoin remains the most popular. Its market value has ballooned to more than 42.9 billion US dollars, according to the website coinmarketcap.com.

The unit has seen wild volatility during its short life, soaring from just a few US cents to around 2,500 US dollars now, more than double its value just a few months ago.

An image of Bitcoin and US currencies is displayed on a screen as delegates listen to a panel of speakers during the Interpol World Congress in Singapore on July 4, 2017. /VCG Photo

Backers say virtual currencies offer an efficient and anonymous way to store and transfer funds online.

Critics argue the lack of legal framework governing the currency, the opaque way it is traded and its volatility make it dangerous.

Bitcoin's reputation was damaged when US authorities seized funds as part of an investigation into the online black market Silk Road.