导读:中国财团参与竞标英国国家电网公司燃气管道资产拍卖的消息,经媒体披露后在英国引发争议。有议员呼吁抵制中企参与,更有媒体盘点中国正在如何“买下”英国。

A new row over Chinese investment broke out last night after it emerged that one of the country’s firms is bidding to take control of half of Britain’s gas pipelines.

中国企业参与英国天然气竞标的消息昨晚爆出之后引发了轩然大波,因为竞标一旦成功就会控制英国一半的天然气管道。

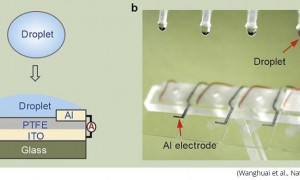

State-owned operator China Gas has joined with Shanghai-based investment firm Fosun to bid for a majority stake in the National Grid’s ?11 billion gas distribution business.

中国燃气是国有企业,和上海投资公司复星集团一起参加了英国国家电网天然气输送业务的竞标,估值约为110亿英镑。

It operates four gas distribution pipelines that supply an estimated 11 million homes and businesses in the Midlands, the North West, eastern England and north London. The Chinese consortium is one of three trying to buy a controlling stake.

这次招标的英国国家电网公司天然气管道项目,涉及英国1100万家庭用户和企业用户,不仅覆盖伦敦北部,还有英格兰的中部、西北部以及东部多个地区。中国财团是想要购买控股权的三个财团之一。

At the time, a source reportedly said: ‘The only time it drops off is during Chinese New Year.’ Yesterday, Tory MP John Redwood said the UK was being far too generous to countries such as China – and demanded government intervention to stop state monopolies buying up our industries.

同时,有消息源称:“中国财团唯一松懈的时候就是春节的时候”。保守党议员约翰·雷德伍德昨天表示,英国对中国这样的国家太慷慨了——并敦促政府进行干预,阻止中国国有垄断企业购买英国产业。

He said the Government needed to be much ‘firmer’; likening the situation to the failure to stop the Stock Exchange being taken over by the Germans.

他说,政府需要变得更“坚决”一些;现在的问题就好像阻止伦敦证券交易所被德国人接管的努力失败了一样。

‘There could be security concerns, but my main concern is that this is not a fair market,’ he said. ‘I have suggested to the Government that they should amend the competition rules to allow intervention if the bidder is a foreign government or is a foreign nationalised industry.

“可能会有安全上的担忧,但是我主要的担忧还是市场不公平。”他说,“我建议政府修订竞争条款,这样就能干预外国政府或者外国国有企业的竞标。”

‘This is on the grounds that Britain cannot do the same and invest in their industries like this. As I understand it, there is a lot of Chinese state money behind this potential deal. They do not allow us to invest in their economy in the same way. We have been far too generous in the past.’

“出于一些原因,英国不可能做到同样的事,不会像他们这样投资他们的产业。就我个人的理解,在这潜在的交易背后,一定有中国政府的财政支持。他们不允许以同样的方式投资他们的产业。我们过去一直都太慷慨了。”

National Grid has decided to carve out the gas operations into a stand-alone business. It is selling its pipelines so it can focus on more profitable parts of its business.

英国国家电网决定将天然气业务单独分离出去。该公司卖出了其国内天然气业务的控股权,这样就能集中在业务中更加赚钱的部分了。

While the gas itself is owned by the various energy companies, National Grid is responsible for it while it is being transported.

天然气本身属于不同的能源公司,英国国家电网只是负责运输业务。

Liberal Democrat leader Tim Farron said: ‘This government is getting it completely wrong when it comes to energy security.

英国自由民主党领袖蒂姆·法农说:“政府在能源安全这整一件事上办得都不对。”

‘Instead of working with our allies to develop sustainable, low-cost energy solutions, we are offering up our ageing systems based on fossil fuels to the highest bidder, without considering whether it is in our long-term national interest.’

“我们没有和我们的盟友合作发展可持续、低成本的能源战略,却拍卖我们老旧的化石燃料系统,价高者得,根本不考虑长期国家利益。”

National Grid said: ‘We will not speculate on the identity of potential bidders. Regardless of their identity, all bidders will have to go through the same rigorous approval process. The new owner will have to be approved by regulators and operate under the relevant requirements.

英国国家电网表示:“我们将不会考虑潜在竞标者的身份。在不考虑身份的情况下,所有竞标者都要通过严格的审批程序。新的经营者将由监管者进行审批,并在相关法律下进行运作。”

‘Networks are subject to strict rules and criteria in terms of security, reliability and availability and any buyer will need to prove to Ofgem and the Government that they can meet these criteria.’ Government sources said the deal would be subject to the additional safeguards that Mrs May put in place following the Hinkley decision.

“能源网络服从于严格的安全性、可靠性和可行性规则和标准。任何竞标者需要得到英国天然气电力市场办公室和英国政府的最终批准。”政府来源的消息称,梅首相为欣克利角核电站项目追加了一些安全条款,而这次交易必须遵守这些条款。

A No 10 spokesman said: ‘We have a robust regulatory system in place, and any inward investment must meet the relevant legal and regulatory standards and requirements.

一名唐宁街10号发言人表示;“我们强有力的监管系统已经就位,任何对内的投资都必须遵守相关法律监管标准和要求。”

‘The additional safeguards proposed last week mean that in future there will be a formal gateway through which investments in critical infrastructure are interrogated for their implications for national security.’

“上周提出的追加条款,意味着未来重要基础设施方面的投资将会有正式的途径,对国家安全的影响也会受到审查。”

The second bid for the pipelines is led by the Canada Pension Plan Investment Board, and the third by Australian bank Macquarie and another Chinese player – China Investment Corporation.

在天然气管道项目上,出价第二高的是加拿大养老金计划投资委员会主导的财团,第三高的是澳大利亚投行麦格理集团领衔的财团以及另一家中国企业——中国投资公司。