事实上,美国不少大城市也正在面临着同样的财政困境。美国财经网站(零对冲)“Zero Hedge”近日便刊文列出了美国多座信用风险极高的城市,其中就包括洛杉矶、亚特兰大、休斯顿等数座知名大城市,而曾盛传濒临破产引发外界担忧的芝加哥更是“名列前茅”。

芝加哥风险最高

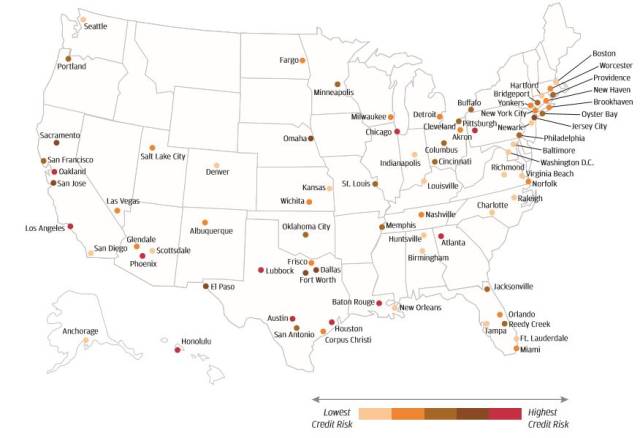

这篇名为《下一个申请破产的美国城市是哪里?》的文章称,“如果你住在这些‘红色’的城市里,那可能是时候要开始寻找另一个家了。”从图上可以看出,这些“红色”的城市包括奥克兰、洛杉矶、菲尼克斯、奥斯汀、休斯顿、亚特兰大和匹兹堡等城市,圣安东尼奥、萨克拉门托、达拉斯等城市的级别也仅次于“红色”。

▲美国各大主要城市信用风险级别(图片来源:摩根大通)

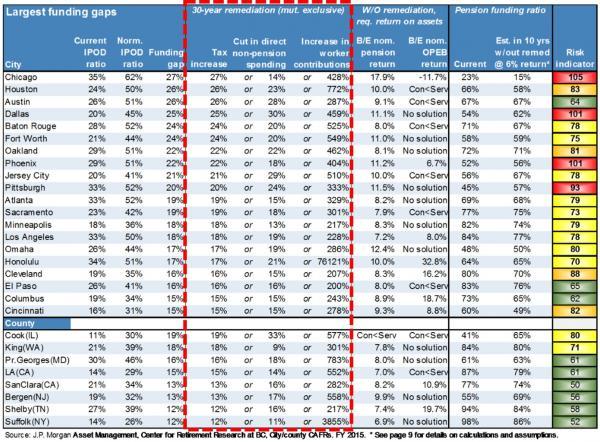

每日经济新闻记者注意到,下图是摩根大通根据美国每座主要城市年支付债务、养老金以及退休金占全年预算的比例来进行排名的。而这一排名的最终结果也让人大跌眼镜——知名城市芝加哥的风险指标最高,芝加哥具名60%以上税款将用于偿还债务和养老金,其次是达拉斯与菲尼克斯,以及匹兹堡。与此同时,还有十几座其他城市的年度预算中,超过50%用于为以往支出的维护成本提供资金。

摩根大通在一份报告中写道:

作为700亿美元美国市政债券的管理者,我们非常关注美国市政债券的信用风险。

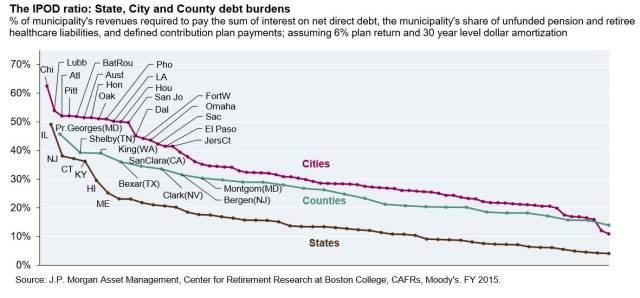

下面的图表显示了美国各州、各市、县的“IPOD”比率。这代表市政财政收入占需要支付直接债务所产生的利息的百分比,并且在30年的时间里,完全摊销养老金和退休人员的医疗保健义务(假设保守的计划资产回报率为6%)。

虽然没有硬性规定,但在税收、非养老金支出、基础设施投资、对无资金计划和债券偿还的贡献方面,拥有超过30%的IPOD比率的市政当局可能最终会面临非常困难的局面。

▲美国各州、市、县的财务负担(图片来源:摩根大通)

从这幅图中可以看出,在“IPOD”比率最高的几个州分别为伊利诺伊、新泽西、康涅狄格、肯塔基和夏威夷;就城市而言,“IPOD”比率最高的则分别是芝加哥、拉拔克(Lubbock,德克萨斯州一市)、亚特兰大和匹兹堡。

记者还注意到,今年6月初,穆迪和标普双双调降伊利诺伊州信用评级至接近垃圾级别,是美国各州史上的最差评级。

▲截自彭博社相关报道

穆迪曾将芝加哥评为“垃圾”级

美国第三大城市芝加哥曾靠钢铁行业、制造业起家,上世纪70年代,钢铁行业不景气、制造业企业外迁,芝加哥不断遭遇挑战。近年来,芝加哥面临着政府财政入不敷出、巨额赤字难以化解的压力,尽管在过去的五年时间内芝加哥市的年收入增长均值为5%,但还是被国际三大评级机构之一的穆迪投资者服务机构(Moody's Investors Service)下调债务评级为“垃圾”级。

根据城市联合会(Civic Federation)追踪的城市财政数据,在2002年开始的10年间,芝加哥大举借债,公债借款增加了84%。这使每个芝加哥居民负担的债务增加了1300美元。

以下是早期VOA英语关于美城市将面临破产的相关报道:

Detroit Mayor Dave Bing had to report some bad news last month. He said Detroit was seeking bankruptcy protection. The move would give the city court protection from creditors.

"This is very difficult for all of us but if it's going to make the citizens better off, then this is a new start for us."

The decision to declare bankruptcy is an offer to restruction and reduce debt. It comes at a difficult time for Detroit.

In March, Michigan Governor Rick Snyder named Kevyn Orr, a bankruptcy expert to oversee the city's financial problems.

Detroit has been struggling to reduce a budget deficit of more than $300 million. In addition, the city's long-term debt has increased to at least $18 billion.

Detroit's problems have grown over many years. Michigan State University professor Eric Scorsone says the city depended too much on one-industry.

"You know, Unlike Chicago, New York and other cities where had economic diversity, Detroit really didn't. It had the auto industry, it had suppliers to the auto industry, and so as those went away, the city began a very long decline that's really occurred over 50 years essentially."

Jobs with car manufactures were a big reason why Detroit was one of the country's largest cities half a century ago. In the 1950s, it had a population of about 1.8 million people. Today, the number is down to less than 800,000.

Robin Boyle is a professor of urban planning at Wayne State University. He says over the years, many Detroit residents moved to areas outside the city, or even left the state. That hurt Detroit's ability to invest in the city.

"They have so little disposable income to reinvest in their communities, that if they have money they leave, they go to the suburbs or they go to find work elsewhere, further putting us into this vicious cycle that drives us further and further down. How you break that is the challenge in Detroit."

It is rare for a large city to seek bankruptcy protection. In 1975, New York City came close before the federal government agree to provide money.

Detroit, however, is the largest city to seek bankruptcy. A federal judge will consider Detroit's request. The judge's decision is expected in one to three month.

One of the main issues is what to do about the retirement pay of city workers. Currently, there are many more retired workers than those pay into the pension system.