京东美国上市

中国第二大电子巨头京东正式在美国纳斯达克交易所挂牌,已成功在美国上市。

China’s second largest e-commerce company JD.com has entered the capital US market by debuting on the Nasdaq. Its IPO is amongst the biggest this year, challenging Amazon and eBay as Wall Street’s favorite online retailers.

The company raised about US$1.8 billion in its IPO, with shares priced at US$19 per share. JD.com is the latest in a string of Chinese tech and Internet companies to go public in the US.

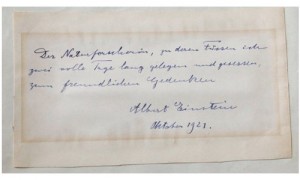

Qiangdong Liu, CEO of JD.com, raises his arms to celebrate the IPO for his company at the Nasdaq MarketSite, Thursday, May 22, 2014 in New York.

Friedman LLP’s Eddie Wong says that US capital markets are extremely lucrative for Chinese companies.

"The US capital market, I believe, is a lot more mature than the Chinese capital market. The Chinese capital market is still in the very young stage. They don’t have a lot of handle, how to handle the ups and downs and the investment of their market. If you look at the US population, the middle class population is huge, as compared to the Chinese middle class population. Those are the people who would have a lot of disposable income to invest into the capital market," Wong said.

JD.com is often compared to its rival Alibaba. But while JD.com sells its goods directly to customers and has an Amazon-like network of warehouses and delivery trucks, Alibaba acts as a marketplace that connects vendors with customers and does not own the goods it sells.

Although JD.com’s offering is smaller than Alibaba’s, market participants will be closely monitoring JD.com for an indication of how just voracious investor appetite is for Chinese technology stocks. Experts say that JD.com was in a race to list before Alibaba and may one day overtake the giant.

"Right now, they may be smaller than Alibaba but who knows in two to three years from now," Wong said.

JD.com is just one of many Chinese firms attracted to the higher valuations they get in the US market. Last year, eight Chinese companies went public in the US, and almost all of them saw impressive returns.