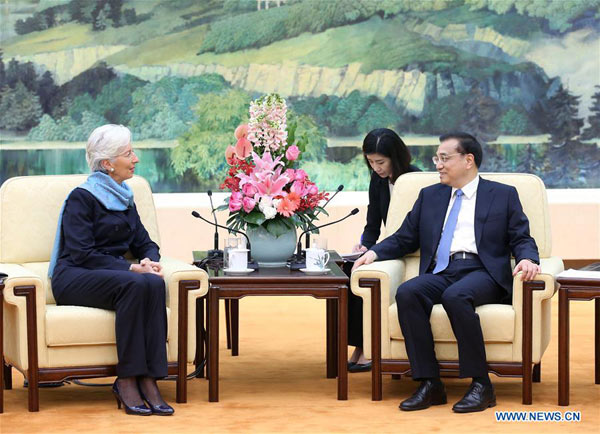

China is opposed to any "currency war", which would be detrimental to the smooth recovery of the world economy, said Premier Li Keqiang while meeting with Christine Lagarde, managing director of the International Monetary Fund, in Beijing on Monday.

China will not use yuan depreciation to boost exports, since this would affect the country's efforts to upgrade its economic structure, he said.

The premier said China will push forward reform of the yuan's exchange rate mechanism and ensure the yuan's exchange rate floats within a reasonable band and is kept largely stable at an appropriate and balanced level, according to an official statement.

China's debt ratio - especially that of the central government - is quite low, while the country's savings rate is high, he said.

Moreover, Chinese banks' capital adequacy ratio, which measures their capability to tackle risk exposure, is kept at a high level, meaning that China is capable of preventing any regional or systemic financial risks from materializing, Li said.

He urged the major economies to improve macroeconomic policy coordination to anchor the global economic and financial system.

China is willing to promote dialogue with major international economic and financial institutions, including the IMF, to send messages that help boost market morale and promote economic and financial stability, Li said.

Lagarde, who was in Beijing to attend the China Development Forum, which concluded on Monday, said China's recent communication with the international community on such issues as the yuan's exchange rate is effective and helps improve market confidence.

In a statement on Monday, Lagarde said China is in the midst of a historic transition aimed at transforming and rebalancing its economy, while delivering economic and environmental sustainability.

"This transition is good for China and good for the world. As with any major transition, we should expect that it will at times be bumpy. A delicate balance needs to be struck between shifting to a relatively slower but more sustainable pace of growth, and implementing much-needed structural reforms," she said.

Lagarde said she was impressed by the Chinese government's commitment to an ambitious policy agenda, including through opening up the economy, narrowing the gap between rich and poor, and expanding innovation and entrepreneurship - three policy imperatives that she described as the "ONE principle".

"The IMF's decision to include renminbi as part of the SDR basket starting in October this year, along with the approval of the 2010 governance reforms which place China among the IMF's top three shareholders, are a testament to China's growing leadership in the global arena - a role that is set to increase even further in the future," said Lagarde, who paid a two-day visit to China where she met many senior leaders in charge of economic and financial affairs.

Analysts said the world economy has become ever more interconnected and, as a result, policy coordination among major economies has become indispensable.

Long Guoqiang, deputy director of the Development Research Center of the State Council, said, "The international community should strengthen dialogue and policy coordination to offset the negative spillover effect of policies devised by individual economies."

The United States Federal Reserve has hinted at possible interest rate increases this year, causing international capital to flow out of the emerging-market economies.

Li Xiaokun contributed to this story.

Contact the writer at xinzhiming@chinadaily.com.cn